Welcome to Intrinsic Value

Your Comprehensive Value Investment Toolkit

Elevate your investment game with IntrinsicValue.ai - where powerful tools meet personalized strategies.

Sign up nowUnlock a Suite of Powerful Tools Tailored for Various Investor Types

For Value Investors

| Feature | Description |

|---|---|

| FTSM Algo Trader | Tailor your trading to fit your preferences. |

| FTSM Ranking system | Evaluate stocks based on their intrinsic worth. |

| Intrinsic Value Calculator | Precisely assess a stock's intrinsic worth. |

| Business Model Summary | Gain insights into the company's core operations. |

| Financial Statements | Access annual and quarterly reports. |

| Cash Flow Analysis | Understand the company's cash movements. |

| Balance Sheet Overview | Evaluate financial stability. |

| Financial Ratios | Assess key performance metrics. |

| Mutual Fund Holdings | Track total holdings by all Mutual Fund schemes. |

For Momentum Investors

| Feature | Description |

|---|---|

| FTSM Algo Trader | Tailor your trading to fit your preferences. |

| FTSM Ranking system | Evaluate stocks based on trends and trend changes. |

| Notification System | Stay informed with trend change alerts. |

| Cutting-edge Charting Technology | Utilize the world's best for technical analysis. |

| Customizable Technical Strategy | Tailor your approach to fit your preferences. |

| AI Analysis of News & Insider Events | Leverage artificial intelligence for in-depth insights. |

| Sentimental Ranking | Assess sentiment based on news and events. |

| Monthly Mutual Fund Changes | Stay updated on net changes in total holdings. |

Unlock a Suite of Powerful Tools Tailored for Various Investor Types

For Value Investors

| Features | Description |

|---|---|

| FTSM Algo Trader | Tailor your trading to fit your preferences. |

| FTSM Ranking system | Evaluate stocks based on their intrinsic worth. |

| Intrinsic Value Calculator | Precisely assess a stock's intrinsic worth. |

| Business Model Summary | Gain insights into the company's core operations. |

| Financial Statements | Access annual and quarterly reports. |

| Cash Flow Analysis | Understand the company's cash movements. |

| Balance Sheet Overview | Evaluate financial stability. |

| Financial Ratios | Assess key performance metrics. |

| Mutual Fund Holdings | Track total holdings by all Mutual Fund schemes. |

For Momentum Investors

| Features | Description |

|---|---|

| FTSM Algo Trader | Tailor your trading to fit your preferences. |

| FTSM Ranking system | Evaluate stocks based on trends and trend changes. |

| Notification System | Stay informed with trend change alerts. |

| Cutting-edge Charting Technology | Utilize the world's best for technical analysis. |

| Customizable Technical Strategy | Tailor your approach to fit your preferences. |

| AI Analysis of News & Insider Events | Leverage artificial intelligence for in-depth insights. |

| Sentimental Ranking | Assess sentiment based on news and events. |

| Monthly Mutual Fund Changes | Stay updated on net changes in total holdings. |

What is IntrinsicValue.ai?

IntrinsicValue.ai is a user-friendly application that enables Value Investors to instantly determine the

Intrinsic

Value of any stock with a single click.

The app also features a suite of software tools aimed at aiding investors in selecting stocks and making informed

decisions, relying on solid facts rather than opinions or recommendations.

Emphasizing facts over advice, IntrinsicValue.ai strictly provides data-driven insights based on quantitative

analysis and sophisticated mathematical models, steering clear of offering any stock recommendations or advisory

services.

What is Intrinsic Value?

In finance and investing, intrinsic value refers to the true or inherent value of an asset, such as a

stock, bond, or company. It is essentially an estimate of the underlying worth of an investment, independent of

its market

price.

The concept is often associated with fundamental analysis, which involves evaluating various

financial and non-financial factors to determine the true value of an asset.

We use the Discounted Cash Flow (DCF) Analysis method and multiply it with Confidence rate

that the user inputs to calculate the intrinsic value of a stock or a company.

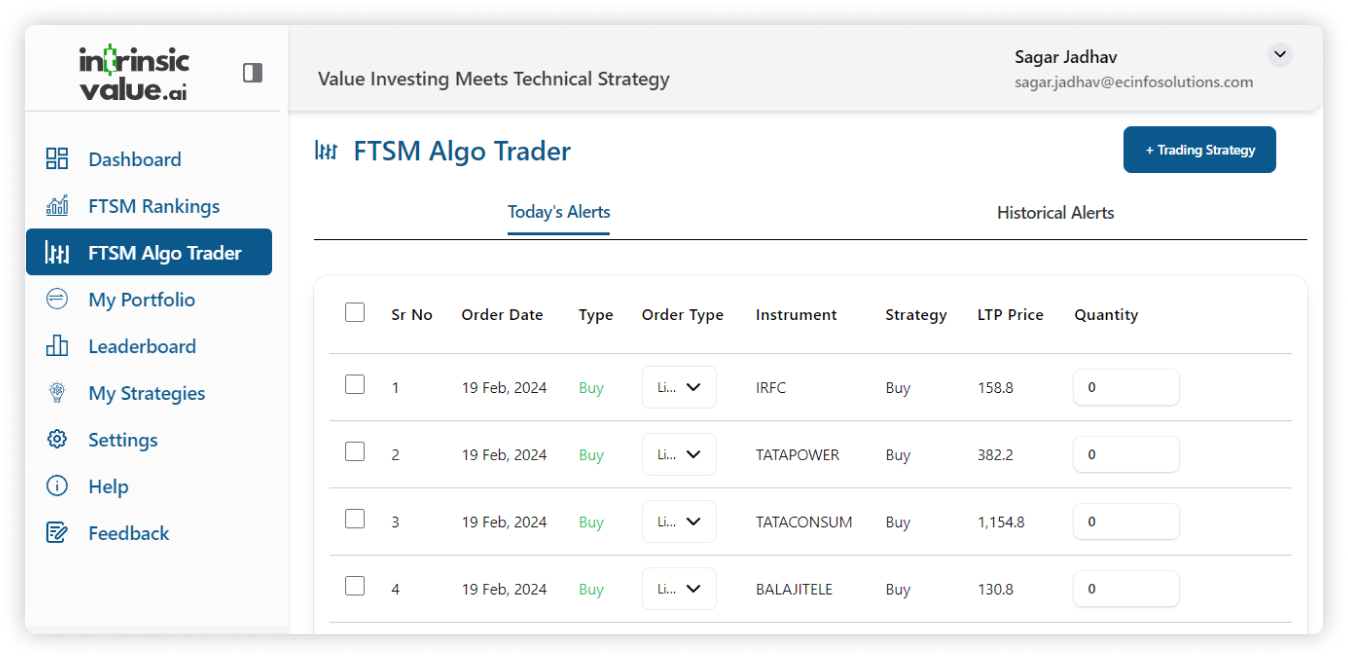

FTSM Algo Trader

FTSM Algo Trader revolutionizes algorithmic trading by offering a new strategy. It

allows for the scheduling of Buy and Sell orders, which you can manually execute through your Zerodha

brokerage account, utilizing the insights from your FTSM Ranking tool.

This system not only

simplifies your

trading process but also ensures transactions are strategically informed by data from the FTSM Ranking tool,

thereby improving both efficiency and precision. However, it's important to note that FTSM Algo Trader only

delivers tailored notifications and alerts, and you'll need to manually place the orders.

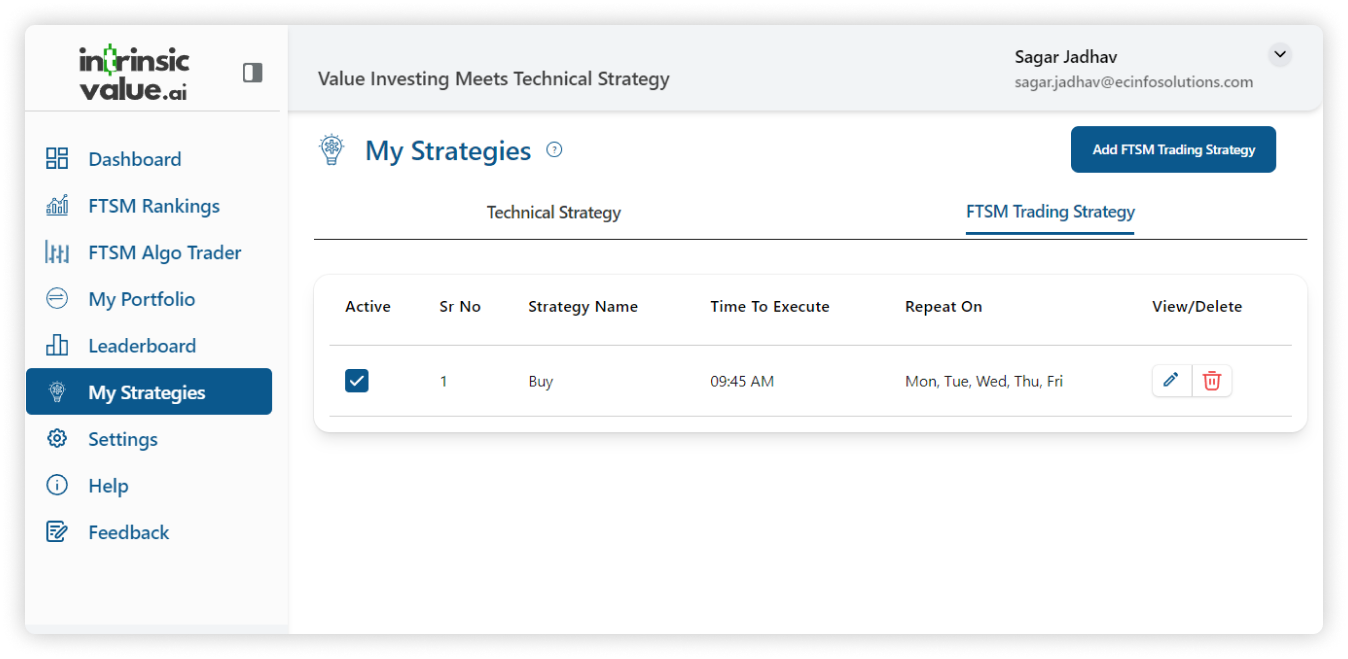

Your Own FTSM Trading Strategy

How are FTSM Watchlist Calculated?

Fundamental Rank

The Fundamental Rank is determined by assessing the Margin of Safety, which represents the percentage difference between the Current Market Price and the Intrinsic Value of a stock. Stocks with the highest Margin of Safety are assigned a rank of 1, while those with lower Margins of Safety, indicating potential overvaluation, are ranked lower.

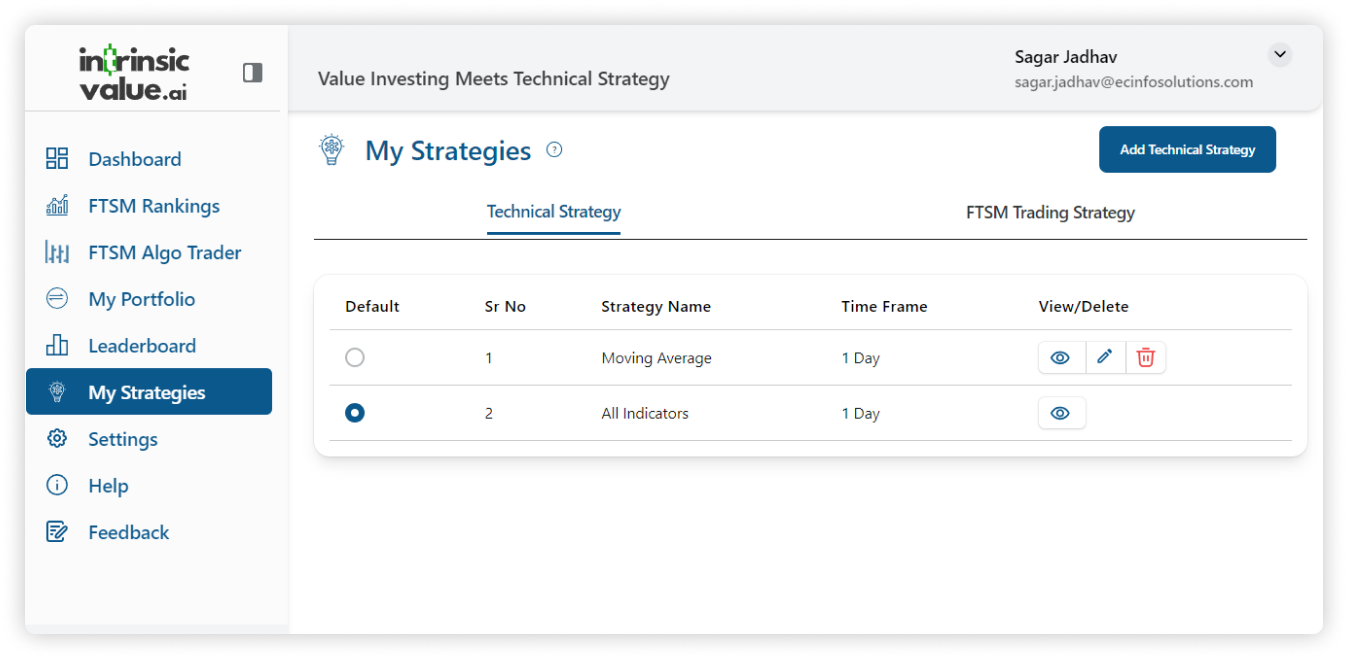

Technical Rank

The Technical Rank is computed by evaluating Positive, Neutral, or Negative indicators related to the stock's price and momentum over a specified time period. Users can tailor the specific technical indicators in the app's My Strategies section. Stocks exhibiting more Positive indicators and fewer Negative indicators receive higher rankings.

Sentimental Rank

The Sentimental Rank is derived from the analysis of Positive, Neutral, or Negative sentiment indicators gleaned from various news headlines related to a specific stock. Stocks with more Positive indicators and fewer Negative indicators are positioned at the top of the ranking.

Mutual Fund Rank

The Mutual Fund Rank is established by considering the net investment value contributed by all Indian mutual fund companies in a particular stock. The rank is influenced by the percentage of net investment in relation to the market capitalization of the company; a higher percentage results in a higher rank.

These ranking methodologies provide a comprehensive evaluation of stocks, incorporating fundamental, technical, sentimental, and mutual fund investment perspectives.

Your Own Technical Strategy

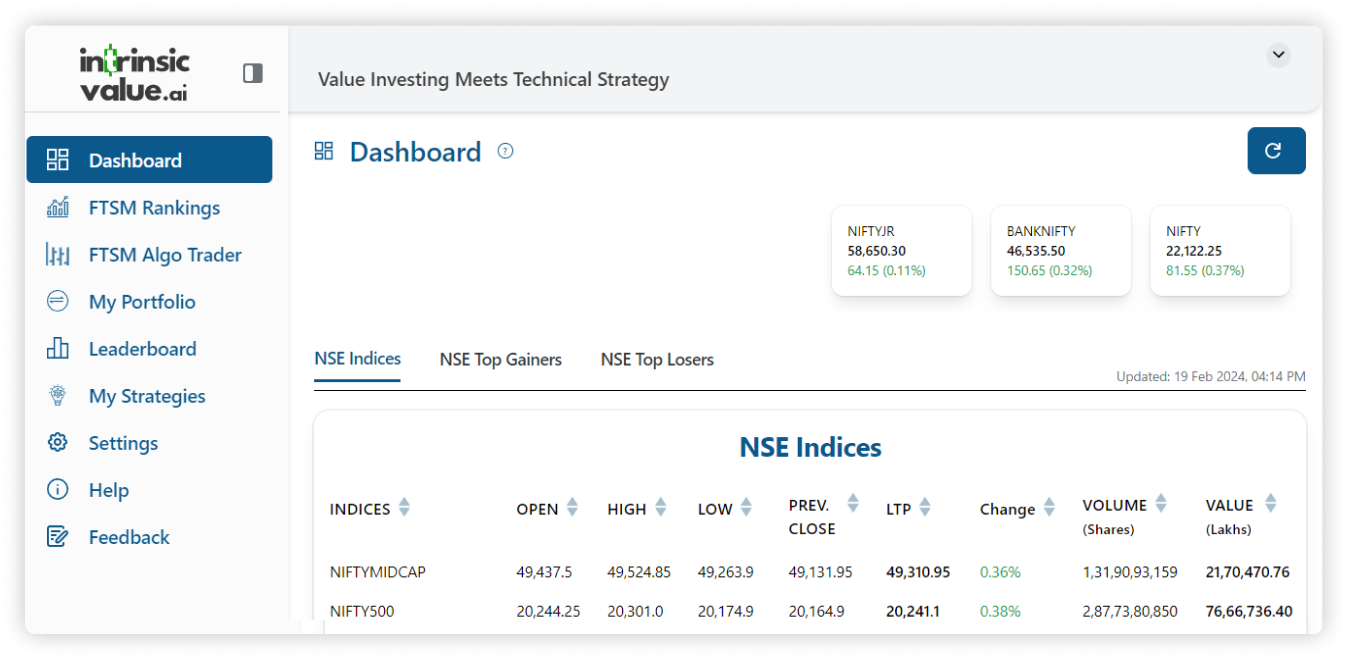

Dashboard

Identify Top Investors: Discover the most talented value and momentum investors on the platform.

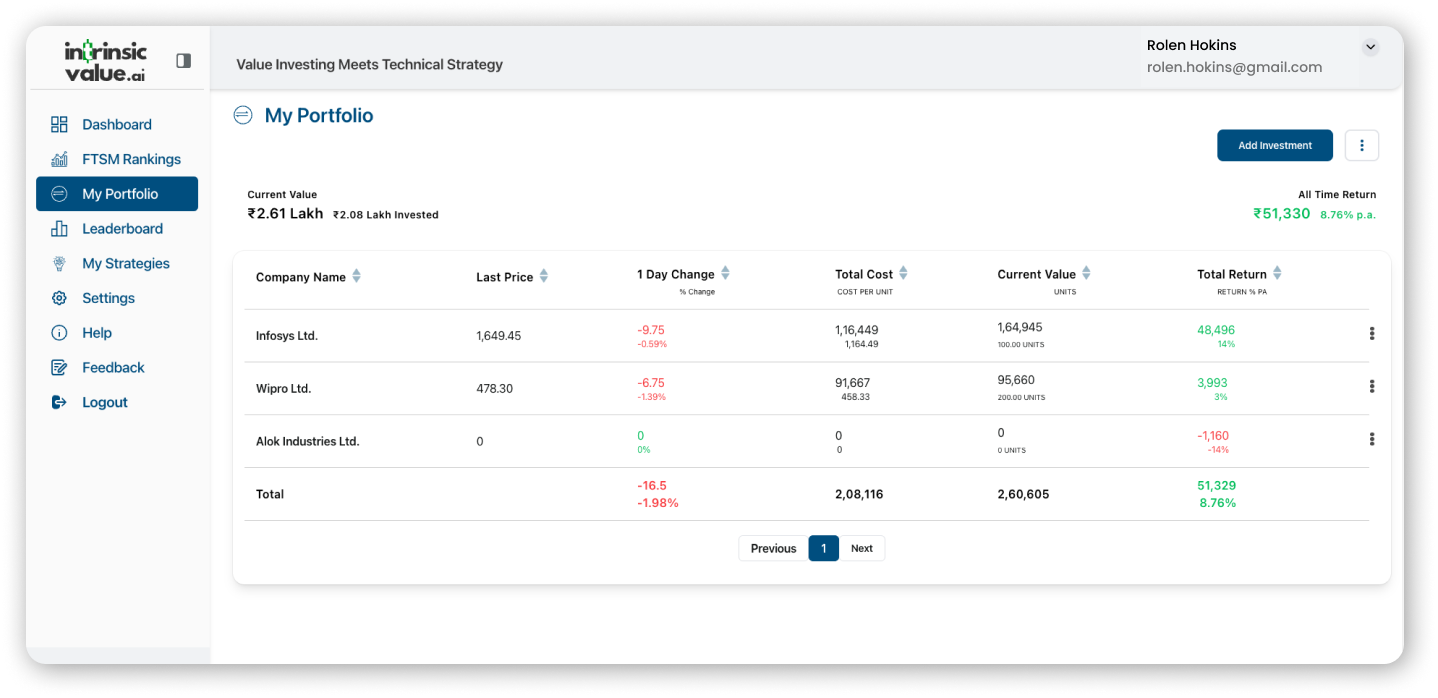

Track your Portfolio & IRR

Track Investments in Real Time. Monitor your portfolio's performance and

returns.

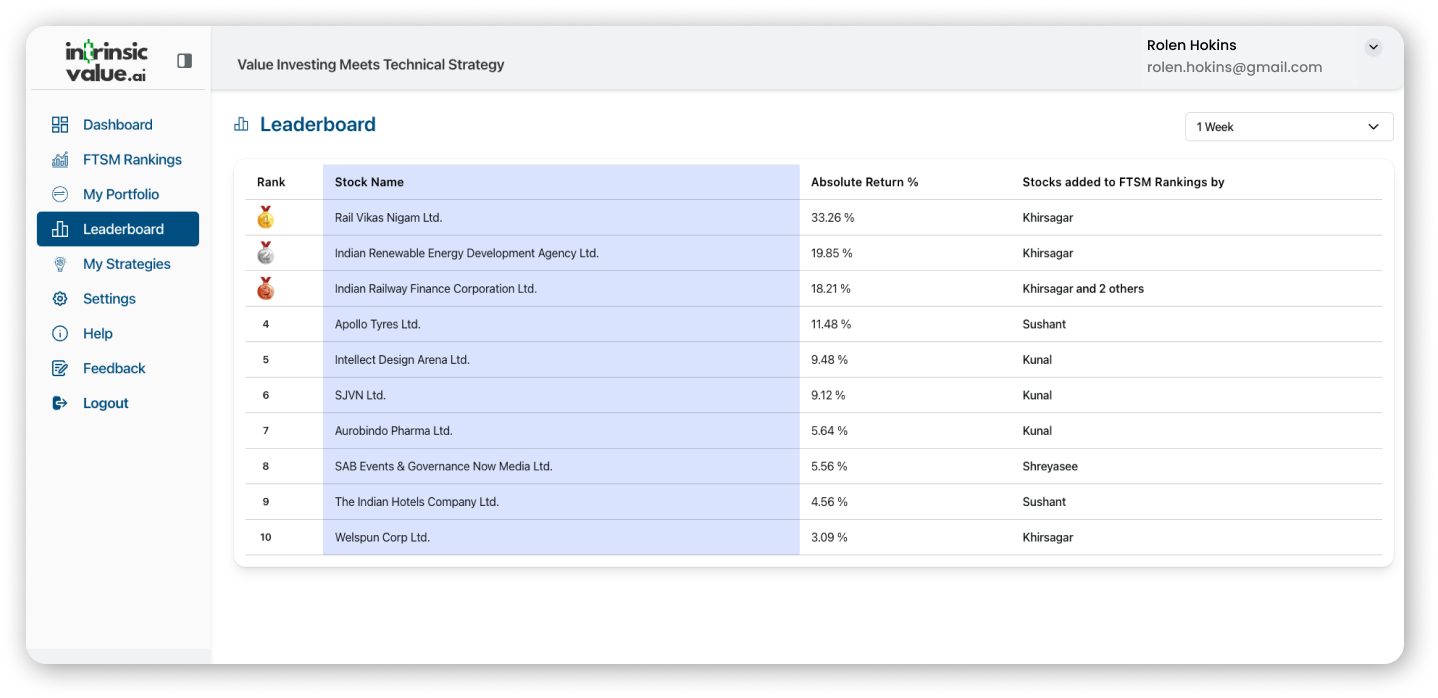

Leaderboard

Identify Top Investors: Discover the most talented value and momentum investors on the platform.

Testimonials

Upcoming Features

- ‚úì Technical Screener & Fundamental Screener: Enhance stock screening capabilities.

- ‚úì Mobile App: Access tools on-the-go.

- ‚úì Multiple Workspaces for Rankings: Personalize your investment approach.

- ‚úì Free Monthly Reports: Stay informed with market insights.

- ‚úì Algo Trading with FTSM Watchlist: Automate your investment strategy.

- ‚úì Backtesting & Quant Tools: Test strategies against historical data.

- ‚úìRisk Management & Value at Risk Analysis: Mitigate investment risks.

- ‚úì Correlation Configurator: Analyze relationships between assets.

- ‚úì Referral & Partner Program: Earn rewards for bringing in new users.